Calculate take home pay from hourly rate

Amanda worked only 5 of the 30 days prior to Labour Day. Download our hourly rate calculator to help you make this calculation.

Mathematics For Work And Everyday Life

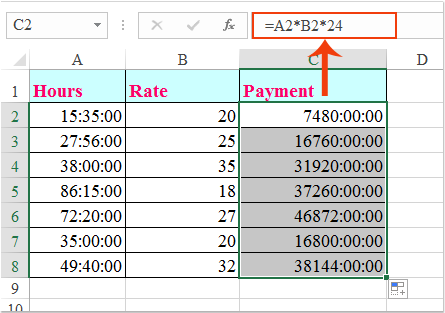

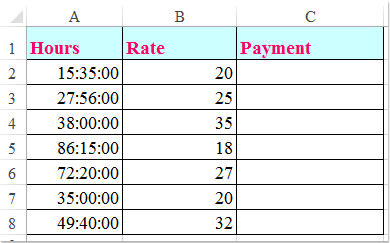

Please see Creating a custom time format in Excel for the detailed steps.

. Mining quarrying and oil and gas extraction. Forestry logging and support. Pay on specified dates twice a month usually on the fifteenth and thirtieth.

If you would like the paycheck calculator to calculate your gross pay for you enter your hourly rate regular hours overtime rate and overtime hours. He currently makes a gross annual salary of 50000. Then add any additional income theyve earned that pay period including overtime pay commissions bonuses etc.

Just enter your annual pre-tax salary. Use our annual salary and hourly rate calculators. Pay each week generally on the same day each pay period.

76923 per week 375 hours 2051 per hour. You can quickly calculate your net salary or take-home pay using the calculator above. Pay every other week generally on the same day each pay period.

Gross pay per check decreases with additional pay periods. His hourly rate was 25. Heres how that gross pay formula would look using a one-week pay period.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. If you earn 27000 a year then after your taxes and national insurance you will take home 22202 a year or 1850 per month as a net salary. Companies in the same industry as The Home Depot.

How can I calculate my take-home pay in Canada. To earn a gross pay of 10000month an employee makes 120000 annually and receives 12 paychecks. He worked for five weeks in the lead-up to Labour Day.

For many finding their hourly pay rate is as simple as looking at a recent pay stub. Simply tell us how many hours you work and what your desired annual salary would be and our calculator will do the sums for you. Bill is an electrician who wants to calculate his take-home net pay.

Pay 2 times a year. Calculate federal state and local income taxes. To calculate your take-home pay follow these steps.

Pay 4 times a year. Already know your hourly rate. Lets take a look.

Determine tax income bracket. If your business is registered for goods and services tax GST youll need to add the 10 GST amount to your hourly rate. Although the annual salary has stayed the same as you can see the hourly rate has changed from 1923 to 2051.

To apply the custom time format click Ctrl 1 to open the Format Cells dialog select Custom from the Category list and type the time codes in the Type box. Woolworths employees with the job title Order Selector make the most with an average hourly rate of AU3172 while. A typical calculation for hourly employees is as follows.

How to calculate take-home pay. And now lets see how our time difference formula and time codes work in real worksheets. Hourly employees multiply the total hours worked by the hourly rate plus overtime and premiums dispersed.

This California hourly paycheck calculator is perfect for those who are paid on an hourly basis. This is where the hourly rate should look different. Example 3 George.

Hourly pay at Woolworths ranges from an average of AU1592 to AU2649 an hour. We publish an annual report and data files on workers with hourly earnings at or below the prevailing Federal minimum wage. I had to consider my self employed tax travel and things I had to pay for to deliver client work.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. You can calculate your hourly rate based on. Pay on a specified day once a month.

If you already know your gross pay you can enter it directly into the Gross pay entry field. Bill lives in Colorado with his. Desired profit amount desired salary operating costs number of income producing hours your hourly rate.

Calculate your FICA taxes for the year. To calculate an hourly employees gross wages for a pay period multiply their hourly pay rate by their number of hours worked. Ranges from an average of 1117 to 1923 an hour.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Calculate your FICA taxes for the year. Salary employees divide the annual salary by the number of pay periods each year.

Calculate the 20-year net ROI for US-based colleges. However if youre a salaried employee or are self-employed calculating your hourly wage takes a few steps. Switch to California salary calculator.

Gross Pay Hours Worked in a Pay Period Hourly Rate Overtime Hours Hourly Overtime Rate Payroll. Hourly pay at The Home Depot Inc. This is because the number of hours per week the employee is getting paid for has reduced.

Hourly Rate Calculator 20222023. When I started life as a UK sole trader I quickly realised that calculating my self employed hourly rate was going to take more than just charging the same as my competitorsOr just simply accepting what clients were willing to pay me. George works 40 hoursweek Tuesday to Saturday 8 hoursday.

She is not eligible for Statutory Holiday Pay in BC. Average hourly rate. If youre unsure of how much you should charge as your hourly rate as a contractor our hourly rate calculator can help.

The Compensation Research and Program Development Group conducts research on methods concepts and technical issues of measuring pay and benefits in BLS surveys. Based on a 40 hours work-week your hourly rate will be 1068 with your 27000 salary. Your gross pay will be automatically computed as you key in your entries.

General Holiday Pay 5 x 48048 2404. With Start times residing in column.

Hourly Rate Calculator

Annual Income Calculator

Mathematics For Work And Everyday Life

How To Multiply Hours And Minutes By An Hourly Rate In Excel

Hourly To Salary What Is My Annual Income

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly To Salary Calculator

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

How To Multiply Hours And Minutes By An Hourly Rate In Excel

Salary To Hourly Calculator

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Gross Pay And Net Pay What S The Difference Paycheckcity

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

How To Calculate Net Pay Step By Step Example

Hourly Rate Calculator

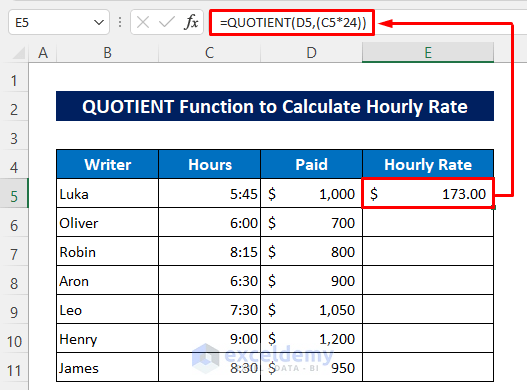

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy